$120,000 (rental income) + $6,000 (Other Income) - $12,000 (Vacancy loss) - $24,000 (Operating expenses)= $90,000 net operating income.Īs you can see, NOI is generally calculated on an annual basis, but it’s relatively simple to also calculate your monthly NOI by dividing this number by 12. Your property has a 10% vacancy loss and $2,000 in monthly operating expenses. Additionally, you rent 5 parking spots for an additional $100/month each. NOI = Rental Income + Other Income - Vacancy Loss - Operating Expensesįor example, let’s say you have a 10-unit property with each apartment renting for $1,000/month. In this example, your NOI would be $19,200. To calculate your net operating income you'd take your annual gross income ($24,000) and subtract your operating expenses ($4,800). hash-mark Net Operating Income Formula NOI = Gross Income - Operating Expensesįor example, let's say you have a duplex that brings in $2,000 a month in gross income, and that your operating expenses total $400 a month. This is best estimated by looking at comparable properties and how they perform.

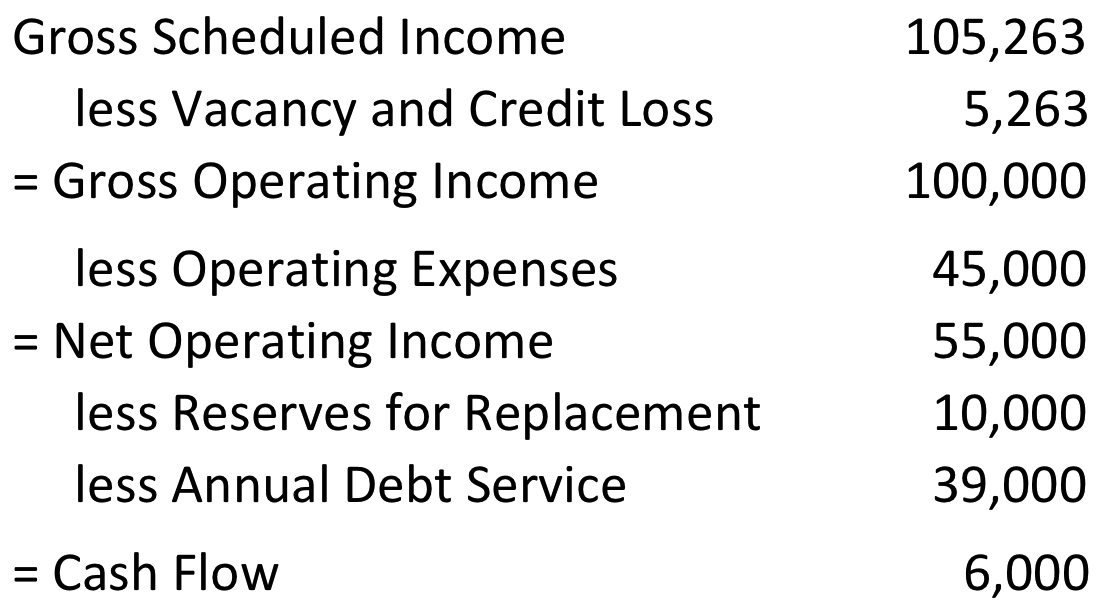

Vacancy and credit loss refers to the rental income you don’t collect due to apartment turnover when tenants move as well as when they don’t pay any rent that’s owed. This can include income from parking fees, on-site laundry machines, and vending machines. Make sure not to forget any non-rent-related income the property generates when you calculate the total revenue the property brings in. To calculate your net operating income, simply add your rental income and other income together and then subtract vacancy and losses and operating expenses. Calculating NOI in real estate is relatively simple as it does not take into account capital expenditures, principal and interest payments, depreciation, or amortization. The net operating income on a property is simply the gross income it generates minus your operating expenses. hash-mark How Do You Calculate Net Operating Income? This analysis is not only useful for investors but also for lenders as by calculating net operating income on a property, they can better determine whether or not the investor will have enough cash flow to make payments on their loan. The benefits of calculating net operating income are that it provides excellent insight into the potential revenue a property can generate on an ongoing basis. Property investors use NOI to analyze and compare investments as well as to calculate the cap rate of a property. NOI is short for net operating income and is a number that is used to calculate the profitability of an income-generating real estate investment such as a rental property.

#Noi commercial real estate how to

What Is NOI? How Do You Calculate Net Operating Income? Net Operating Income Formula What Are Operating Expenses In Real Estate? How To Interpret Net Operating Income Real Estate NOI Pros and Cons Net Operating Income Bottom Line hash-mark What Is NOI? Net operating income (NOI) measures the profitability of an income-producing property before adding in any costs from financing or taxes.

0 kommentar(er)

0 kommentar(er)